Deal Structuring: Share Deal vs. Asset Deal

When a foreign group considers acquiring a French company that owns substantial real estate (e.g. factories, warehouses, logistics centers, shopping complexes), the deal raises specific legal, tax, and regulatory issues. This article, written from a French transaction lawyer’s perspective, provides a comprehensive overview of these considerations. It covers deal structuring options, real estate due diligence, tax implications, foreign investment (FDI) screening, contractual strategies, and post-acquisition integration for such real estate-heavy acquisitions.

Deal Structuring: Share Deal vs. Asset Deal

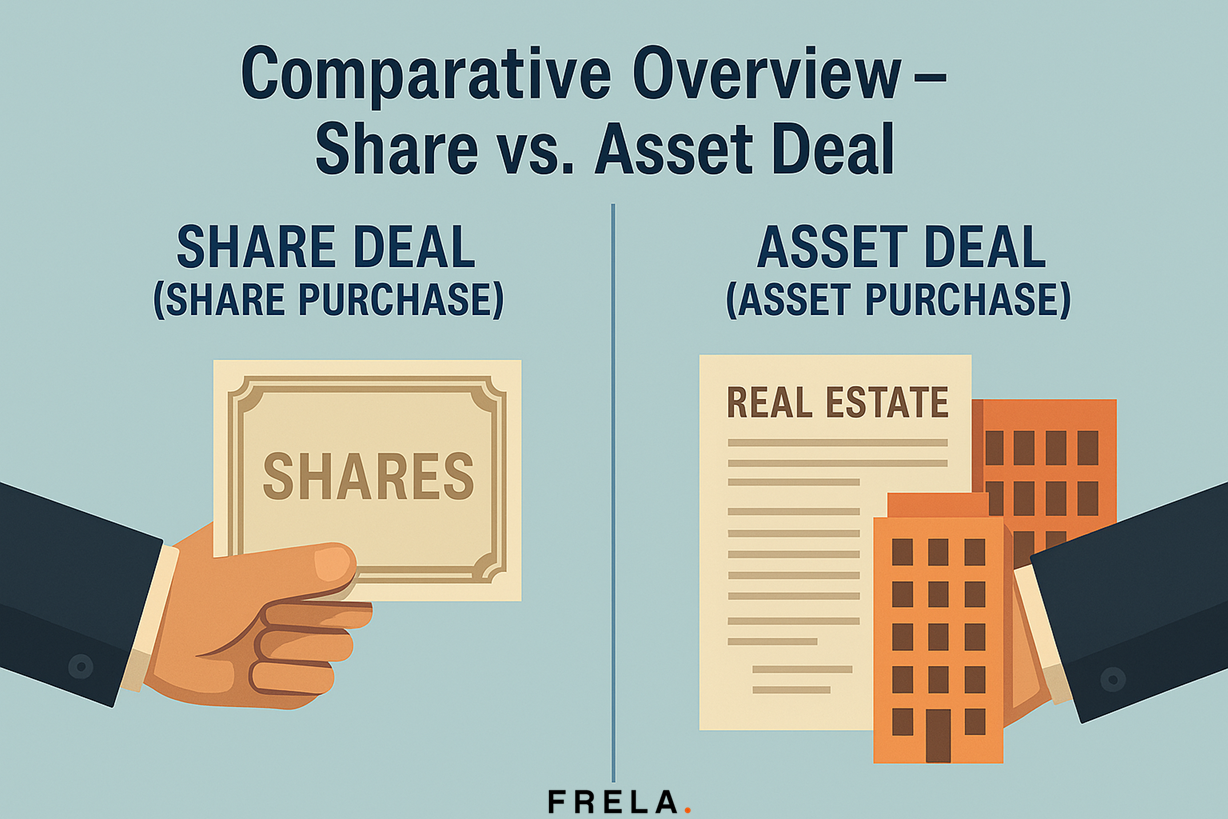

One of the first strategic decisions is whether to structure the acquisition as a share deal (buying the shares of the French company) or an asset deal (purchasing the company’s assets, such as its real estate, directly). Each approach has distinct legal and fiscal consequences:

- Share Deal: The foreign investor buys shares of the French target company, which continues to own its real estate. Legally, this means the company’s identity doesn’t change – all its assets and liabilities remain with it, simply under new ownership. This route is often simpler in terms of continuity (contracts, permits, and employees remain with the same entity) and can be tax-efficient. For example, transfers of shares in French corporations like an SAS or SA are subject only to a 0.1% stamp duty. Even in the case of a real estate-heavy company, share transfers typically incur at most a 5% transfer tax (applicable if the company’s assets are comprised of >50% French real estate). Crucially, a share deal does not trigger a change in property ownership in the land registry – the company still owns its real estate, avoiding direct real estate transfer taxes and notarial formalities on each property.

- Asset Deal: The foreign investor (or its French subsidiary) purchases the real estate assets (and possibly other business assets) directly, often by carving them out of the target company. Legally, this entails transferring title to each property, which in France requires notarized deeds and registration. Each real estate asset sale incurs transfer taxes of approximately 5–6% of the property value (exact rate varies by location), plus notary fees. An asset deal allows the buyer to cherry-pick assets and leave behind unwanted liabilities in the old company, but it is more complex if the target’s business is an ongoing concern – transferring contracts, permits, and employees may require additional steps. Notably, a business asset sale in France (vente de fonds de commerce) or a transfer of a full branch of activity will by law transfer employees to the buyer’s entity and usually requires specific formalities (e.g. public notices for a fonds de commerce sale).

Comparative Overview – Share vs. Asset Deal:

| Aspect | Share Deal (Share Purchase) | Asset Deal (Asset Purchase) |

| Ownership change | Shares of company change hands, but the company remains owner of assets. | Assets (e.g. real estate) are directly transferred to buyer’s entity. |

| Liabilities | Buyer inherits all company liabilities (past and present) along with assets. Protections via warranties/indemnities are crucial. | Buyer generally avoids assuming past liabilities of seller (except those tied to acquired assets), which remain with selling entity. |

| Transfer taxes | 0.1% stamp duty on shares of SA/SAS; 3% (after allowance) for SARL. If company is predominantly real estate, 5% duty applies on share transfer. | ~5–6% property transfer tax on real estate value (notary fees extra). Some asset classes (equipment, inventory) might have no transfer tax. |

| Seller’s capital gains tax | Potential corporate tax deferral/efficiency (shares sale may qualify for participation exemption – effectively ~3% tax for a corporate seller). Foreign sellers often exempt under tax treaties. | Immediate corporate tax (25% CIT) on any capital gains at the seller’s level. Seller’s latent gains on real estate become taxable upon sale. |

| Complexity | Corporate formalities: share purchase agreement and share transfer registers. No change in property titles, so simpler if many properties. Notarial deed not required for share transfer. | Asset-by-asset transfers: requires property due diligence per asset, notarial deeds for real estate, assignment of contracts/leases, and potentially business sale formalities. More time-consuming and costly per asset. |

| Continuity | Target company continues operations uninterrupted under new owner. Contracts, permits, leases etc., remain in place (change of control clauses may need review, but generally no need to re-assign assets). Employees remain with the same company (no automatic transfer needed). | Business may need to be reconstituted in buyer’s entity. Contracts might need novation or assignment; regulatory permits or licenses may need re-application under new entity. Employees of the target business transfer by law to the buyer if a business unit is sold (protecting their rights under French law). |

In practice, share deals are more common for acquiring a company with significant real estate, because they avoid double taxation and disruption. Sellers also prefer share deals since they “trigger fewer taxes and organize the transfer of the liabilities of the target company” to the buyer (any latent gain on the properties remains unrealized in the company’s books). Asset deals might be chosen in specific cases – for instance, if the buyer only wants the real estate itself or if certain liabilities in the company make a share purchase unattractive. Often, dealmakers will consider hybrid approaches as well, such as carving out the real estate into a separate entity prior to sale, or doing a share deal with a post-closing property sell-off (e.g. sale-and-leaseback) as part of the strategy.

About the Author :

Business lawyers, bilingual, specialized in acquisition law; Benoit Lafourcade is co-founder of Delcade lawyers & solicitors and founder of FRELA; registered as agents in personal and professional real estate transactions. Member of AAMTI (main association of French lawyers and agents).

FRELA : French Real Estate Lawyer Agency, specializing in acquisition law to secure real estate and business transactions in France.

Paris, 15 rue Saussier-Leroy, Paris

Bordeaux, 24 Rue du manège, 33000 Bordeaux

Lille, 40 Theater Square, 59800 Lille